- Cost Accounting

What is Reorder Level in Cost Accounting?

Introduction Cost accounting is essential for businesses to understand their costs and make informed decisions. One of the key concepts in cost accounting is th

- Money and Investment

What is a mortgage calculator?

Mortgages are a prevalent method for financing properties. A mortgage is a loan used to purchase a home, and it is typically repaid over a 15- to 30-year term.

- Financial Accounting Concepts

What Do Mean Sundry Debtors and Sundry Creditors?

Sundry debtors and sundry creditors are words frequently used in the business world. These phrases describe the sums of money that a company owes to its supplie

- Cost Accounting

Meaning and Explanation of Service Costing

The term “service costing” refers to the method of calculating the cost per unit of service given. It also refers to the price of particular functio

- Financial Accounting Concepts

What are Liquidity Ratios? – Meaning and Formula

Liquidity ratios measure the short-term financial solvency of a business. Here the short term refers to a period of 12 months or lesser. Investors typically use

- Cost Accounting

What is Fixed Overhead Volume Variance?

The fixed overhead volume variance is also referred to as the production volume variation because this variance is dependent on production volume. The volume va

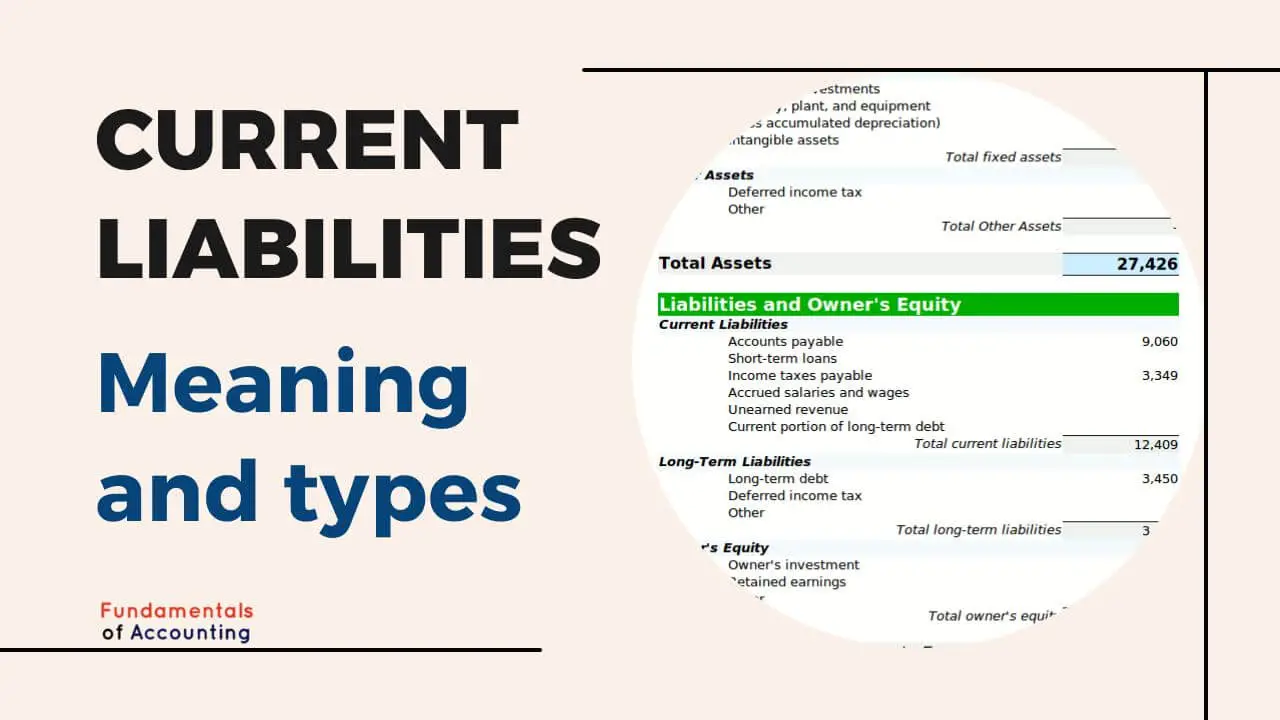

- Financial Accounting Concepts

What are Current Liabilities? Meaning and Types

Liabilities are the obligations to pay money, render services, or deliver goods at a later date as a result of a previous transaction. This definition covers al

- Financial Accounting Concepts

What is the Modified Internal Rate of Return (MIRR)?

In an effort to solve some of the shortcomings of the IRR method, financial analysts have devised an alternate evaluation procedure that is comparable to the IR

- Cost Accounting

What is Throughput Costing?

Throughput costing is a system based on the fact that most production costs will not vary at the level of the individual unit produced. Throughput costing, also

- Financial Accounting Concepts

What Does Mean Substance Over Form?

In accounting, the phrase “substance over form” refers to a preference for the underlying truth of a transaction above its legal form. The accountin