What is the Ledger and its purpose in Bookkeeping?

The ledger is the principal book of the accounting system. After we have finished part of recording the transactions in the Journal, the next part of the accounting process is to post them to the ledger.

It contains various accounts in which transactions relating to that particular account are recorded. A ledger is the set of all the accounts, debited or credited, in the journal and subsidiary books.

A ledger in accounting is the backbone of your financial record-keeping. It’s like a big book or, in modern times, a digital database where all your financial transactions are stored and organized. Think of it as a collection of individual accounts, each dedicated to a specific category of your finances.

Benefits of Ledger

A ledger is very useful and provides valuable information to the organisation. The net result of all transactions regarding a particular account on a given date can be ascertained only from the ledger.

For example, the proprietor on a particular date wants to know the amount due from a specific customer or the amount the firm has to pay to a specific supplier and such information can be found only in the ledger. Such information is very complex to ascertain from the journal because the transactions are recorded in chronological order and are not classified.

For easy posting and location, accounts are opened in the ledger in some specific order. For example, they can be opened in the same order as they appear in the profit and loss account or the balance sheet.

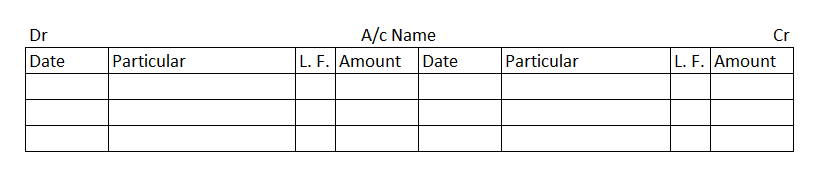

Format of A Ledger Account

A ledger account has two sides-debit (left part of the account) and credit (right part of the account). Each of the debit and credit sides has four columns. (i) Date (ii) Particulars (iii) Journal folio, i.e. page from where the entries are taken for posting and (iv) Amount.

As per this format, the columns will contain the information given below:

The title of the Account: It indicates the name of the particular account.

Dr. /Cr.: it refers to the debit or credit aspect of the transaction.

Date: The date of transactions is posted in chronological order in this column.

Particulars: The name of the accounts and events concerning the original book of entry is written on the debit/credit side of the account.

Journal Folio: It records the page number of the Journal on which the relevant transaction is recorded. This column is filled up at posting and not a recording.

Amount: This column is used to fill the amount of the transaction as recorded in the Journal.

Rules of Posting to Ledger

- A separate account is opened in the ledger book for each account, and entries from the ledger are posted to the respective account accordingly.

- It is a practice to use the words ‘To’ and ‘By’ while posting transactions in the ledger. The word ‘To’ is used in the particular column with the accounts written on the debit side, while ‘By’ is used with the accounts written in the particular column on the credit side. These ‘To’ and ‘By’ do not have any meanings but represent the account debited and credited.

- The concerned account debited in the journal should also be debited in the ledger, but the reference should be to the respective credit account.

Balancing an Account

At the end of each month and year-end, all accounts in the ledger are balanced. Balancing here means ascertaining the net balance of all debit and credit transactions in a particular account.

For the accounts having nature in debit balance, we use ‘by balance c/d’ read as ‘by balance carried down’. On the opening date of the new month, the same balance is written as ‘To balance b/d’ read as ‘To balance b/d’. Similarly, for accounts having a balance in credit nature, balancing is done by writing ‘To balance c/d’ and at the beginning of the new month ‘By balance b/d’ is written.

However, nominal accounts are not balanced at the end of the year; they are transferred to Profit & Loss A/c (Trading A/c in case of Direct expenses). Hence, they have no opening balance at the beginning of the year. Only personal and real accounts can show balances.

Conclusion

In summary, a ledger is the core of your accounting system. It’s where all your financial transactions are recorded, organized, and analyzed, giving you a clear picture of your financial health and making informed decisions for your business or personal finances.